Why Small Business Owners Should Hire a CPA?

Did you know that just 30% of entrepreneurs have accountants? In addition, just 22% recruit CPAs (Certified Public Accountants). But CPAs can be necessary to your independent venture - while you're beginning yet in addition, while you're attempting to keep your business above water.

Here's the reason your independent venture could require a CPA.

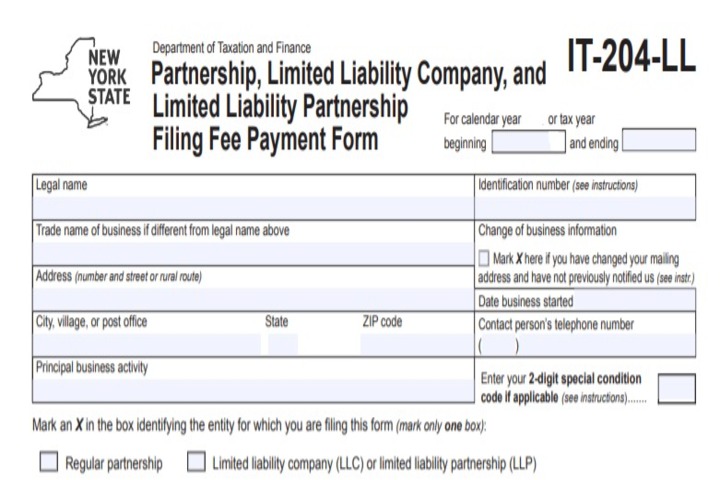

Save Startups Money

Assuming you're going to begin another business, it tends to be particularly valuable to talk with a CPA first. Would it be advisable for you to set up your business incorrectly? Can it set you back a ton to fix it? A CPA can assist you with the lawful construction of your business, for example, regardless of whether you are an enterprise, LLC, or sole owner. You might need to pay all the more later to change licenses, protection or banking if you want to change the design.

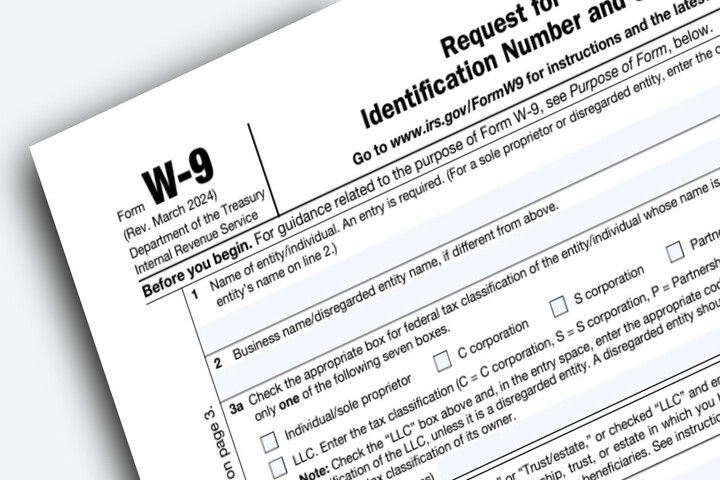

Get Best Tax Experts Advice

Planning and documenting charges for a business will be entirely different than doing individual assessments, particularly assuming that you have workers or have clients in different states. A CPA can set up your business charge archives, record your returns, and even encourage you on ways of lessening your duty of responsibility. A CPA will likewise know about any duty changes and can go about as a delegate assuming you're evaluated.

Get Additional Accounting Services

CPAs can accomplish more than your assessments. They can keep an overall record plan fiscal summaries offer month to month, quarterly or yearly accounting set up a bookkeeping framework plan spending and estimate income, and give finance administrations to your business. They can likewise offer significant monetary guidance for new organizations. It pays to work with one individual who can do everything.

CPAs Advice You in Important Business Changes

Assuming you choose to roll out a major improvement - like a move, blend, business buy, or conclusion - you will presumably need to talk with a CPA. There can be charge suggestions for your business, and in any event, for you as a person by making such a major change. CPAs can examine monetary records or check resources to secure another business. Assuming that you're wanting to sell, they can assist you with setting up the monetary records and give you an honest evaluation of your business.

While numerous private companies endeavor to do their assessments or their own accounting, a CPA could set aside the time and cash. Recruiting one, regardless of whether you're simply beginning another business or have been maintaining a business for quite a long time, can assist you with settling on troublesome monetary choices and assist you with anticipating the eventual fate of your business.

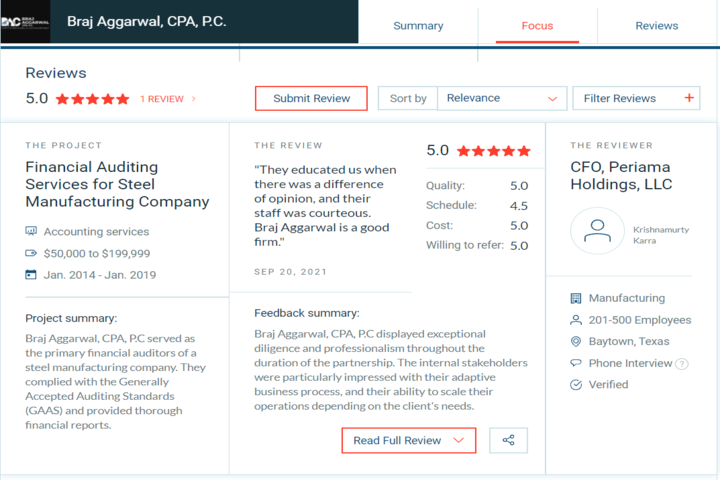

If you are a small business owner and want to hire a qualified CPA Firm in New York. Who will handle all your accounting and taxation at the time? Braj Aggarwal CPA, P.C. is a top-rated accounting firm in queens and we have a highly experienced accountant and tax preparation experts’ team. Want to discuss your accounting needs visit our website. www.aggarwalcpa.com