Forensic Accounting Services: Why Partnering with a CPA Firm Could Save Your Business

With financial systems becoming more intricate and globally connected, the occurrence of fraud and suspicious financial activity is on the rise. Businesses today face growing risks, not only from external threats but also from within their own operations. As these deceptive practices become harder to detect, the demand for professionals who can uncover the truth behind the numbers has intensified.

Forensic accounting steps in at the crossroads of finance and investigation. It’s a highly specialized field that requires more than just accounting knowledge it calls for sharp investigative skills, legal awareness, and a deep understanding of how frauds are carried out. From tracing hidden assets to presenting findings in legal proceedings, forensic accountants play a critical role in exposing financial misconduct.

Why Big Corporate frauds led to the need for Forensic Accounting

Big financial scandals in companies like Parmalat, Xerox, and Satyam, along with major fraud cases at Enron, WorldCom, and HealthSouth, showed just how easy it can be for fraud to go unnoticed in large organizations. Then came Bernie Madoff’s huge Ponzi scheme, which shocked the world and affected thousands of investors.

These events made it clear that regular accounting wasn’t enough to catch complex fraud. That’s where forensic accounting came in. It became a much-needed tool to investigate suspicious activities in companies and help uncover hidden frauds before they cause more damage.

What is Forensic Accounting?

Forensic accounting is a special kind of accounting that’s all about digging deep into financial records to find out if something suspicious is going on. It’s used to investigate problems like fraud, missing money, or dishonest financial reporting.

Unlike regular accounting, which focuses on keeping track of income and expenses, forensic accounting looks closer at the details to find signs of wrongdoing. It helps uncover hidden mistakes, dishonest behavior, or anything that doesn’t add up often to help settle legal issues or catch financial crimes.

What Does a Forensic Accountant Really Do?

A forensic accountant is like a financial detective. Their job is to dig deep into financial documents and uncover anything suspicious. They don’t just look at the surface they go behind the numbers to figure out if something dishonest is happening.

Here are some of the key things a forensic accountant does:

- They carefully review financial statements to spot any signs of fraud or unusual activity.

- They check for mismatches or errors in reports showing what a company owns and owes.

- They follow the money trail to uncover illegal activities

Their work often helps in legal cases, insurance claims, or disputes where money is involved. In short, they help find the truth when the numbers don’t seem to add up.

Where and When is Forensic Accounting used?

Forensic accounting is used whenever there’s a need to get to the bottom of financial problems. It’s especially helpful for businesses dealing with internal issues, money disputes, or suspected fraud.

Forensic accountants can work in many different places. Some are hired by companies to look into financial concerns, while others work with banks, insurance firms, police departments, government agencies, or even in court cases. Anytime there’s confusion, conflict, or suspicion around money, that’s where forensic accounting comes in handy.

Why Forensic Accounting Matters for Businesses?

- Helps Spot Fraud Early - Catching dishonest activity early can save a business from serious long-term damage.

- Protects a Company’s Reputation - Financial scandals can ruin trust uncovering issues quickly helps maintain a good image.

- Reduces Financial Loss - Studies show businesses lose about 5% of their yearly revenue to fraud. Forensic accounting helps cut that down.

- Supports Legal Disputes - In shareholder or partnership disagreements, forensic accountants provide solid, trustworthy reports that can stand in court.

- Keeps Assets Safe - By finding stolen or hidden money, they help protect what's rightfully the company’s.

- Ensures Transparency - Their work brings clarity to financial matters, which is key to honest business practices.

- Guides Smart Decisions - With clear financial insights, business owners can make better choices and stay in control.

How Forensic Accounting different from Regular Audits?

Regular audits check if financial statements are accurate and follow accounting rules. They rely on samples and management input to give a general opinion on the company’s finances.

Forensic accounting, on the other hand, digs deep to uncover fraud or suspicious activity. It’s more investigative, doesn’t follow a fixed time period, and focuses on specific areas where wrongdoing is suspected. The findings often help in legal cases and identifying who’s at fault.

Forensic Accounting Services We Offer

Our forensic accounting services cover a wide range of solutions, including:

- Fraud Detection and Investigation: We investigate suspicious transactions and financial irregularities to identify potential fraud or misconduct.

- Financial Dispute Resolution: Our forensic accountants provide support in resolving financial disputes, ensuring a fair and accurate assessment of financial records.

- Asset Tracing and Recovery: In cases of theft, embezzlement, or financial misconduct, we trace assets to ensure recovery.

- Bankruptcy and Financial Distress Assessments: We help businesses assess their financial health and develop strategies to recover from financial distress.

- Risk Management and Fraud Prevention: We work with businesses to implement strategies and controls that prevent financial fraud and improve overall risk management.

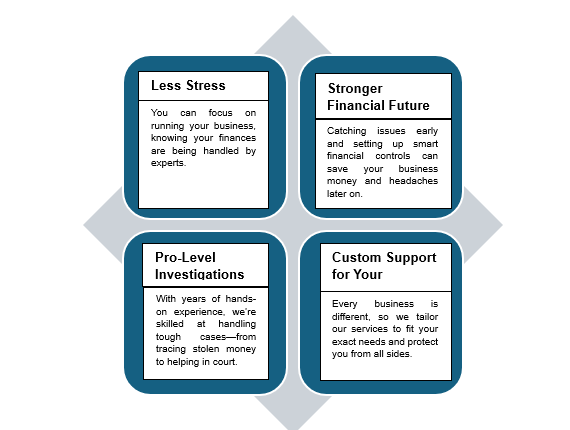

Why Partner with a Licensed CPA Firm Like Ours?

We as a licensed CPA firm in New York, go beyond numbers to protect what you’ve built. With sharp insight and trusted expertise, we uncover the truth and guard your success. Our expert forensic team uncovers hidden risks and protects your bottom line. We don't just solve problems we prevent them before they start. Make us your success partner, and move forward with confidence. For more information, feel free to reach out us Braj Aggarwal CPA, P.C.