Setting up Business in USA: Employer Identification Number (EIN) and Why Do You Need One?

When starting a business anywhere in United States or the U.S. Territory, one of the mandatory requirements to run the business is to obtain an EIN (Employer Identification Number) from the Internal Revenue Service (IRS).

- What is an EIN?

- Why is EIN important and where do we need it?

- Do you need an EIN?

- How to apply for an EIN?

-

What is an EIN?

An EIN is a nine-digit number that IRS assigns to business entities operating in U.S, to identify the business and for tax purposes. It is similar to Social Security Number assigned to individuals. As business is deemed to be separate from the owner for taxation purposes, it is mandatory for most businesses to apply for an EIN with IRS.

- The EIN is in the format XX-XXXXXXX.

- EIN is also known as Federal Tax Identification Number.

- EIN is unique i.e. no two businesses share the same EIN

-

Why is EIN important and where do we need it?

EIN is needed not only to meet your legal requirement but also for many other reasons.

To Start a Business:

Most businesses would need an EIN, regardless of the business wanting to hire employees.

However, in case of a Sole proprietorship, the business is not a separate legal entity from the individual. Hence, as in most cases, the sole proprietor can use their Social Security Number (SSN) instead of an EIN. Nevertheless, there could be situations where a sole proprietor would be required to obtain an EIN by law or where an EIN would be recommended but not legally necessary.

Open a U.S. Business Bank Account:

To open a bank account specific for your business, bank would need an EIN along with other documents. Any business can open a bank account in U.S. only if the entity is registered in U.S. and has an EIN. Sole proprietors may use Social Security Number to open a bank account if they do not have an EIN.

Apply for Business Permits and Licences:

To apply for business permits and licences one would require EIN along with other documents.

File Taxes:

To file the business tax return as a legal entity, separate from the owners, one would require an EIN for the business. EIN is used by IRS to identify a business and its tax obligations depending on the entity type.

Hire Employees:

Small businesses generally do not require employees apart from the owner. However, if you plan to expand and grow your business and hire employees, you would require an EIN. An EIN will help not only comply with many regulations for employment but also help take care of employee tax withholdings and set up payroll.

-

Do you need an EIN?

You will need an EIN if you fall under any of the below categories –

- If you have employees.

- If you operate your business as a corporation or a partnership.

- If you file any of these tax returns - Employment, Excise, or Alcohol, Tobacco and Firearms.

- If you withhold taxes on income, other than wages, paid to a non-resident alien.

- If you have Keogh Plan.

- If you are involved with certain specific types of organization as specified by IRS.

-

How to apply for an EIN?

There are 4 different ways in which you can apply for an EIN. If you are a US citizen and have your SSN, then you can apply under any of the methods mentioned below.

However, if you are not a U.S. citizen and do not have a SSN or Individual Tax Identification Number (ITIN), you cannot apply for an EIN through online application or by phone. The process to get an EIN is more complicated and requires additional paperwork.

Online Application

Online Application is the most preferred way to Apply for an Employer Identification Number Online. The information in the application is validated in the online session once the application is completed. On successful validation, the EIN is issued immediately.

Apply by Fax

To apply by Fax, completed Form SS-4 containing all the required information is to be faxed to the appropriate fax number. If the taxpayer provides his fax number, the new EIN would be sent by fax within four (4) business days.

Apply by Mail

Application for EIN by mail is a slower process with processing timeframe of four weeks. Completed Form SS-4 containing all the required information is to be mailed to the appropriate IRS Office mailing address. The new EIN would be assigned to the taxpayer by mail.

Apply by Telephone – International Applicants

To obtain an EIN, International Applicants may call the assigned number (not toll free). The applicant making the call must be authorized to receive the EIN and must answer the questions concerning Form SS-4 to complete the application over the phone.

The Third Party Designee sections to be updated and completed only if the taxpayer wants to authorize the individual to receive the entity’s EIN and answer questions concerning Form SS-4 completion. For Third Party Designee authorization to be valid the form must also be signed by the taxpayer.

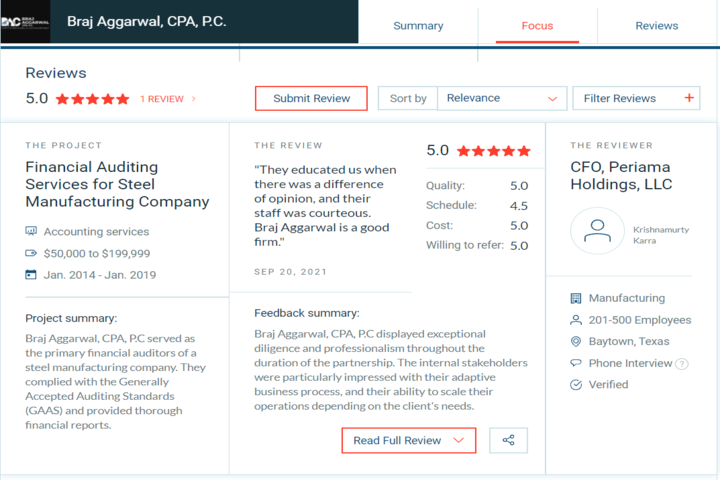

Book a FREE MEETING with us and we could guide as to how your business can be incorporated. We also provide post incorporation services to help you grow your business as well as stay legally compliant.

If you are still unsure if you need an EIN or find it difficulty with obtaining an EIN, book a FREE MEETING with us today.

Once incorporated, you might also need additional support to sustain and grow your business in the right manner as well as complying with all the necessary legal and regulatory aspects.