Who is Eligible for Wage Parity?

Wage Parity benefits are accessible to all hourly home consideration laborers or assistants who are utilized by offices situated in New York City (counting Bronx, Kings, Queens and Richmond Counties), Nassau, Suffolk, or Westchester.

The accompanying home consideration organizations should consent to The New York Wage Parity Law:

• Confirmed Home Health Agency (CHHA)

• Long haul Home Health Care Program (LTHHCP)

• Overseen Care Organizations (MCO)

• Authorized Home Care Services Agency (LHCSA)

• Restricted License Home Care Service Agency (LLHCSA)

What Supplemental Benefits Are Available?

- Adaptable Spending Account (FSA)

An adaptable spending account, or FSA, is a record that permits members to contribute pre-charge cash to pay for un-repaid clinical, dental and vision costs. Bosses can contribute $500 each year to every member's FSA account. Managers can permit members to contribute up to an extra $2,700 whenever wanted by means of a pre‐tax finance allowance. Not at all like conventional FSA accounts these assets can be turned over to the next year.

- Dental and Vision Health Reimbursement Account (HRA)

Managers contribute into this record to assist members with paying for their out‐of‐pocket dental and vision care costs. There is no restriction to what a business can contribute this record. Left-over assets can be turned over to the next year.

- Travel Reimbursement Account (TRN)

This advantage repays members for movement to work and places of work. Bosses can contribute up to $265 each month for mass travel, vehicle administration and an extra $265 each month for business related leaving.

- Subordinate Care Reimbursement (DCAP)

This advantage assists members with paying for qualified childcare and grown-up day care. Managers can contribute up to $5,000 each year.

- Mobile phone Reimbursement Account

Assuming PDAs are utilized for business related correspondences, bosses can repay up to $100 each month to pay for worker's PDA bill.

What Are the Benefits of An Employer Providing Wage Parity?

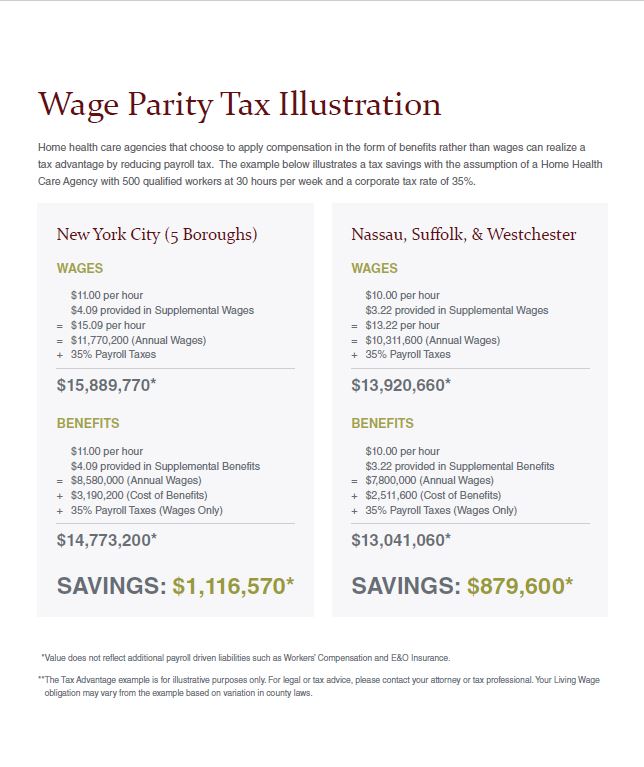

Tax Advantages:

Businesses who decide to finance the supplemental wages as an advantages program, as opposed to coordinate pay, will probably profit from the expense benefits. Wage Parity Benefits that are paid to the member are tax-Exempt and businesses see a decrease in finance charges.

At Braj Aggarwal, CPA P.C we will assist your regarding Wage Parity and if you want to know more about Wage Parity audit service get in touch with us or call: (718) 426-4661 and Email us on baggarwal@aggarwalcpa.com