Understanding How FICA Tips Credit Worked

As now the time comes Restaurant owners are looking to finalize their previous year books and filing federal tax return. But wait are you a restaurant owner whose employee get tipped by customers. Employee payslip can include standard hourly wages, meal value, tips, service charges, special event compensation, and more. Each type of compensation may require a different tax treatment. As a result of keeping track of so many details, many restaurant owners are not taking advantage of an important tax credit potentially available to them.

Do you want to know how much you saved in taxes by taking employee tips credit in your federal tax return 1120?

First lets understand the topic in depth

What is the FICA tip credit?

The FICA tip tax credit, generally Known to as the “Credit for Portion of Employer Social Security Taxes Paid with Respect to Employee Cash Tips,”

This is a tax relief to restaurant owners who pays an employer’s share of employment taxes on tip income paid to their employees by someone else.

Purpose of FICA tips Credit

- Incentive to Employer so they report employee full income including all tips.

- Eliminates employer intention to hide underreported Tips Income

- More revenue is likely to be collected

- More transparency in working.

Who is Required to Report Cash Tips?

Employees who get more than $20 in tips in a month are required to report the sum of tips they receive to their employer at least once a month.

The difference between the standard minimum wages and cash you pay your employee is called a tip credit.

So for a tipped employee, Minimum wages end up looking like this:

(Tipped minimum wage) + (Tip credit) = (Standard minimum wage)

What is the maximum Tip Credit allowed?

Each state has its own minimum wages, tipped minimum wages and maximum tips credit:

(Source: US Dept. of Labor, Minimum Wages for Tipped Employees) – Updated as on July 1, 2021

Table of Minimum Hourly Wages for Tipped Employees, by State.

Please click here to know about Table of Minimum Hourly Wages for Tipped Employees, by State.

FICA Tip Credit Savings Calculator

Tipped employee are generally paid hourly rate and well below the federal minimum wages.

Step 1: To Calculate the credit, employer first have to calculate creditable tips.

Creditable Tips = Total Tips – (Difference of federal minimum wages – cash wages paid by employer).

Step 2: Multiply the creditable tip amount by Combined FICA (6.2%) and Medicare taxes (1.45%) I.e., total 7.65% to determine the amount of credit available.

This calculation is also illustrated by the following example which help you to simple understand the topic:

Example 1.

XYZ Inc operates a restaurant and employed Individual Mr A. During July, Individual A worked 80 hours, was paid $480 in wages, and received $1000 in tips.

- Federal minimum wage amount: $580 (80 hours x $7.25)

- Net tips ineligible for the credit: $100 ($580 minimum - $480 wages paid)

- Creditable tips: $900 ($1000 total tips, less $100 ineligible amount)

- Total credit: $68.85 ($900 x 7.65%)

So Net amount eligible for credit against taxes = $68.85

Example 2.

MNC Inc operates a restaurant and employed Individual Mr N. During July, Individual N worked 80 hours, was paid $600 in wages, and received $1000 in tips.

- Federal minimum wage amount: $580 (80 hours x $7.25)

- Net tips ineligible for the credit: $0 ($580 minimum - $600 wages paid)

- Creditable tips: $100

- Total credit: $76.50 ($1000 x 7.65%)

So Net amount eligible for credit against taxes = $76.5

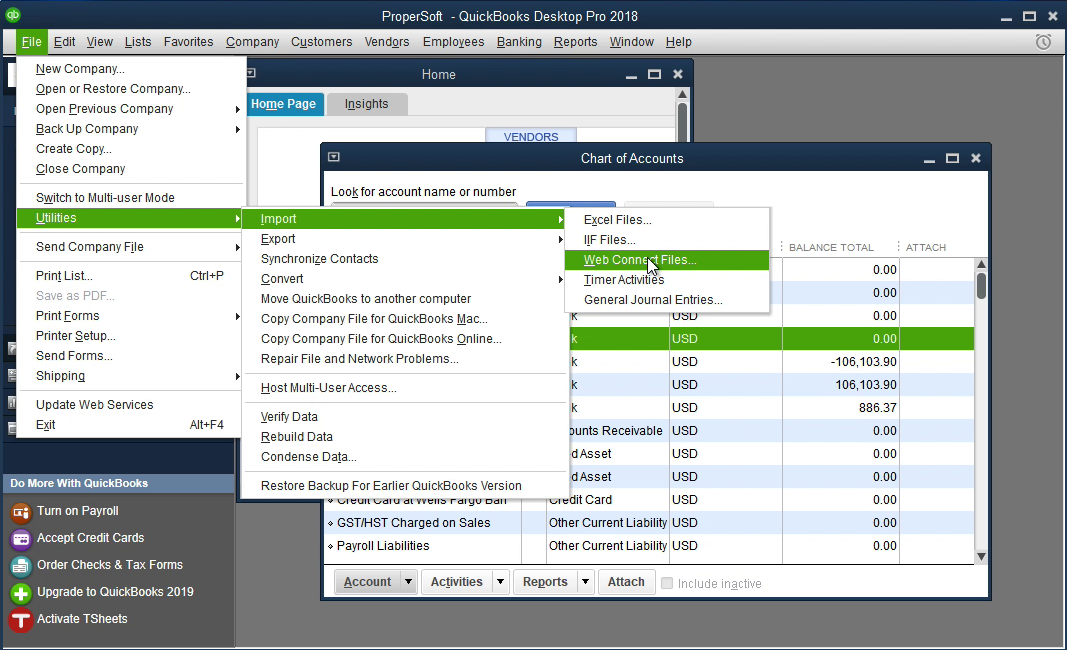

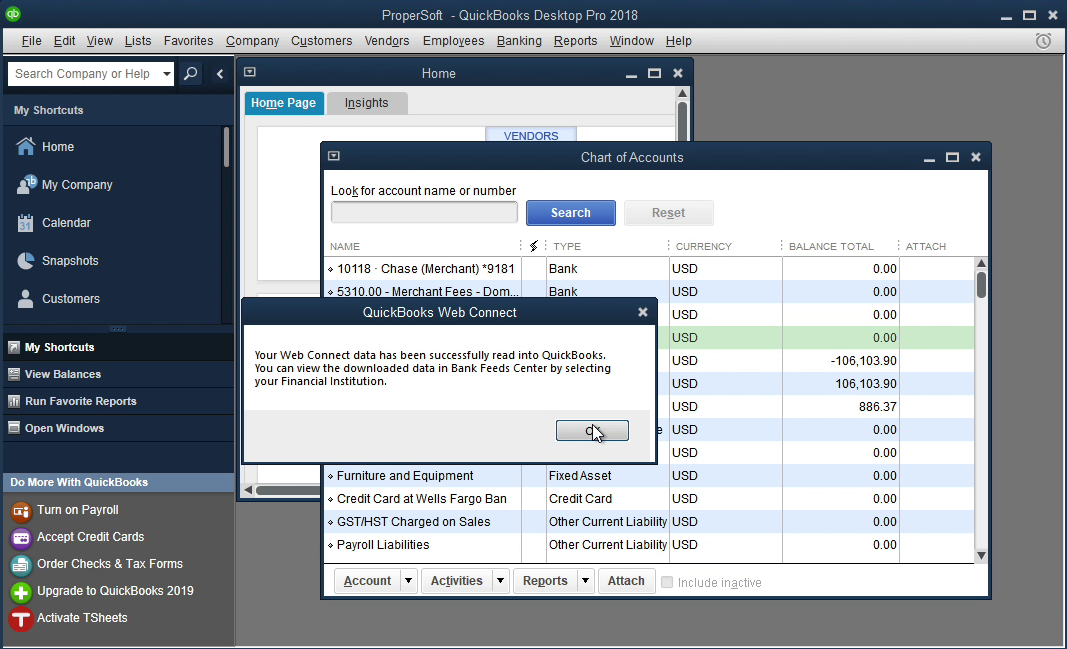

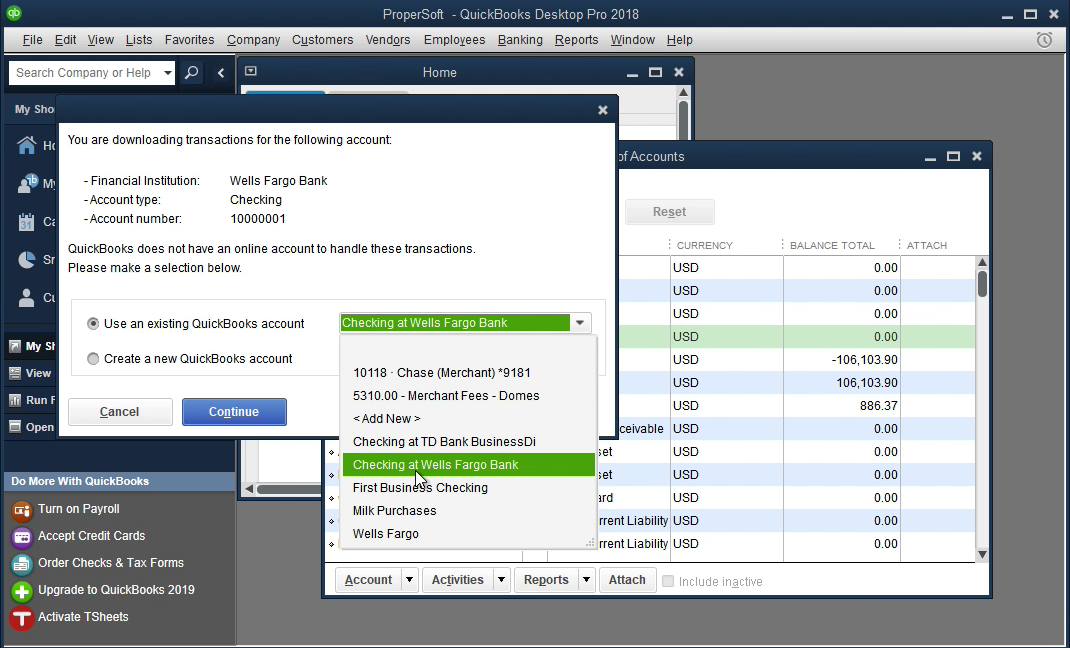

How do I report the FICA Tip Tax Credit?

You can claim the credit of employer social security and Medicare taxes paid on certain employee Tips on IRS form 8846.

This form is filled with Federal Income tax Return

Form 8846 for Example 1

Form 8846 For Example 2

This article is for informational purposes and is not meant to provide legal, regulatory, accounting services or tax advice.

Still Questions about How FICA Tips Credit Worked ? Don't hesitate to call the office and speak to a tax professional. Email us at baggarwal@aggarwalcpa.com or fill up the below form. We will get back to you asap.